Estate Planning Attorney for Dummies

Estate Planning Attorney for Dummies

Blog Article

How Estate Planning Attorney can Save You Time, Stress, and Money.

Table of ContentsHow Estate Planning Attorney can Save You Time, Stress, and Money.Some Of Estate Planning AttorneyExamine This Report on Estate Planning AttorneyThe Basic Principles Of Estate Planning Attorney Fascination About Estate Planning Attorney

Dealing with end-of-life choices and shielding family wealth is a difficult experience for all. In these challenging times, estate preparation lawyers help individuals prepare for the circulation of their estate and develop a will, trust fund, and power of attorney. Estate Planning Attorney. These attorneys, also referred to as estate legislation attorneys or probate attorneys are certified, skilled professionals with an in-depth understanding of the federal and state regulations that put on just how estates are inventoried, valued, distributed, and tired after death

The intent of estate planning is to properly prepare for the future while you're sound and qualified. A correctly ready estate strategy outlines your last wishes specifically as you want them, in one of the most tax-advantageous fashion, to stay clear of any inquiries, misconceptions, misunderstandings, or disputes after death. Estate preparation is a field of expertise in the legal profession.

All about Estate Planning Attorney

These attorneys have a thorough understanding of the state and federal legislations connected to wills and counts on and the probate procedure. The obligations and duties of the estate lawyer may include counseling clients and composing lawful files for living wills, living depends on, estate plans, and inheritance tax. If required, an estate planning lawyer might join litigation in court of probate on behalf of their clients.

According to the Bureau of Labor Statistics, the work of attorneys is expected to grow 9% between 2020 and 2030. Concerning 46,000 openings for attorneys are projected every year, usually, over the years. The path to becoming an estate planning lawyer is comparable to various other method locations. To enter legislation institution, you should have an undergraduate level and a high grade point average.

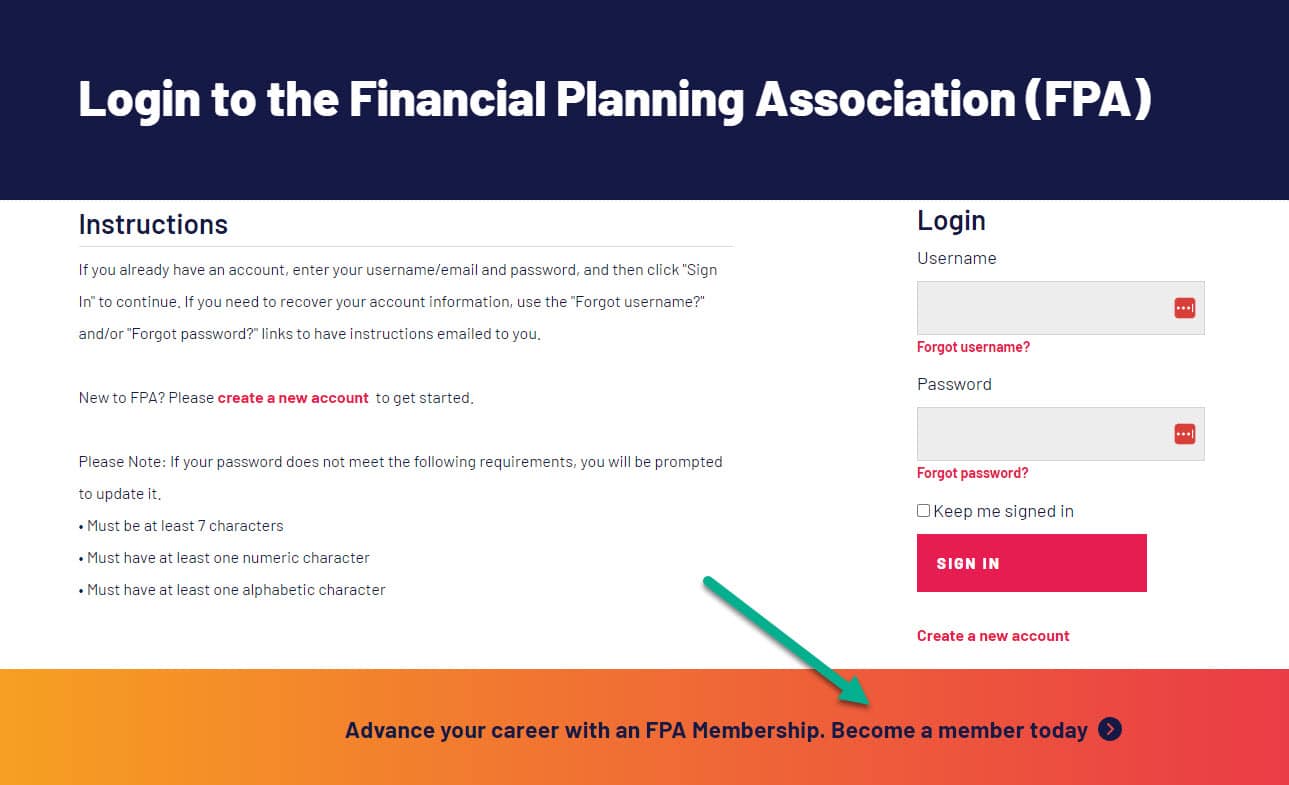

If feasible, consider possibilities to gain real-world job experience with mentorships or teaching fellowships connected to estate preparation. Doing so will provide you the skills and experience to gain admission into legislation school and network with others. The Law School Admissions Test, or LSAT, is a necessary element of relating to legislation college.

Usually, the LSAT is readily available 4 times annually. It's vital to plan for the LSAT. Most potential students start researching for the LSAT a year ahead of time, frequently with a study hall or tutor. The majority of law students use for regulation college throughout the fall term of the final year of their undergraduate researches.

4 Simple Techniques For Estate Planning Attorney

On standard, the annual income for an estate attorney in the U.S. is $97,498. Estate intending lawyers can function at huge or mid-sized law firms or branch out on their own with a solo technique.

This code associates to the limitations and guidelines imposed on wills, trusts, and various other legal files pertinent to estate planning. The Uniform Probate Code can vary by state, yet these laws govern various elements of estate preparation and probates, such as the creation of the depend on or the legal credibility of wills.

Are you unpredictable regarding what occupation to pursue? It is a tricky inquiry, and there is no simple response. You can make some factors to consider to aid make the decision easier. Initially, sit down and note the points you are proficient at. What are your toughness? What do you take pleasure in doing? As soon as you have a listing, you can limit your choices.

It includes deciding how your ownerships will certainly be distributed and that will manage your experiences if you can no much longer do so yourself. Estate preparation is a required part of monetary planning and need to be done with the aid of a qualified professional. There are several elements to think about when estate planning, including your age, wellness, financial circumstance, and family members scenario.

Estate Planning Attorney - Truths

If you are young and have couple of properties, you may not require to do much estate preparation. Nonetheless, if you are older and have better, you need Visit This Link to take into consideration dispersing your assets among your beneficiaries. Health and wellness: It is a vital variable to consider when estate planning. If you remain in healthiness, you might not require to do much estate preparation.

If you are wed, you should think about exactly how your possessions will certainly be distributed between your spouse and your successors. It aims to make certain that your possessions are dispersed the method you desire them to be after you die. It includes taking into consideration any type of taxes that may require to be paid on your estate.

The Best Strategy To Use For Estate Planning Attorney

The attorney additionally helps the people and family members develop a will. A will is a lawful document mentioning how individuals and family members want their assets to be distributed after death. The attorney likewise assists the people and families with their trust funds. A trust fund is a legal record enabling individuals and families to move their properties to their recipients without probate.

Report this page